In a time when financial markets rise and fall unpredictably, investors are searching for stable, long-term wealth-building options. Two popular choices today are Managed Farmlands and Mutual Funds. While both can generate returns, they differ greatly in terms of risk, stability, asset ownership, and long-term wealth protection.

For investors in Bangalore, Karnataka, and nearby urban regions, managed farmland investments have become a powerful alternative — offering land ownership, recurring income, and long-term appreciation.

This guide breaks down the difference between the two, helping you choose the smarter, safer way to grow your wealth.

What Is Managed Farmland?

Managed farmland is agricultural land that is professionally maintained by expert teams. You become the owner of the land, while the management company handles everything like:

- Land development

- Plantation

- Irrigation

- Soil improvement

- Harvesting

- Selling the produce

This allows you to enjoy returns + asset appreciation without doing any manual work.

What Are Mutual Funds?

Mutual funds pool money from multiple investors and invest in stocks, bonds, and other financial instruments.

While they offer good liquidity and diversification, their performance is directly impacted by market volatility.

Managed Farmland vs Mutual Funds – Quick Comparison

| Feature | Managed Farmland | Mutual Funds |

|---|---|---|

| Risk Level | Low to Moderate | High (market-linked) |

| Asset Type | Tangible land you own | Paper-based financial asset |

| Returns | 10–15% annually (land + yield) | 5–8% but fluctuates |

| Volatility | Very low | Highly volatile |

| Inflation Protection | Strong | Moderate |

| Control | High (you own land) | Low |

| Long-term Growth | Strong appreciation | Depends on market cycles |

| Stress Level | Peaceful and stable | Constant monitoring |

Why Managed Farmland Is Becoming a Preferred Choice in Bangalore

Bangalore’s urban population is increasingly choosing farmland investments for:

- Peace of mind

- Stable returns

- Eco-friendly lifestyle

- weekend getaway potential

- Long-term wealth creation

Prime areas like Kanakapura Road, Mysore Road, Channapatna, Ramanagara, Doddaballapur, and Devanahalli are witnessing rapid growth in farmland value.

Top Benefits of Managed Farmland Investment

1. Safe, Stable & Low-Risk

2. Dual Returns: Land Value + Crop Yield

Investors earn:

- Land value appreciation (10 – 15% yearly)

- Annual yield income

This makes it superior to purely market-based investments.

3. Perfect for Long-Term Wealth Creation

Farmland is a legacy asset.

Even if markets crash, land value remains strong.

4. Tangible Asset Ownership

You own physical land — a real, appreciating, secure asset that cannot lose value overnight.

5. Tax Benefits

Agricultural income in India is tax-exempt, making farmland a powerful wealth-building tool.

Where Mutual Funds Fall Short

- Highly volatile

- No control over your investment

- Hidden charges & fund management fees

- Returns fluctuate

- Sensitive to global and national economic events

This makes them unsuitable for people seeking low-risk, stable, long-term assets.

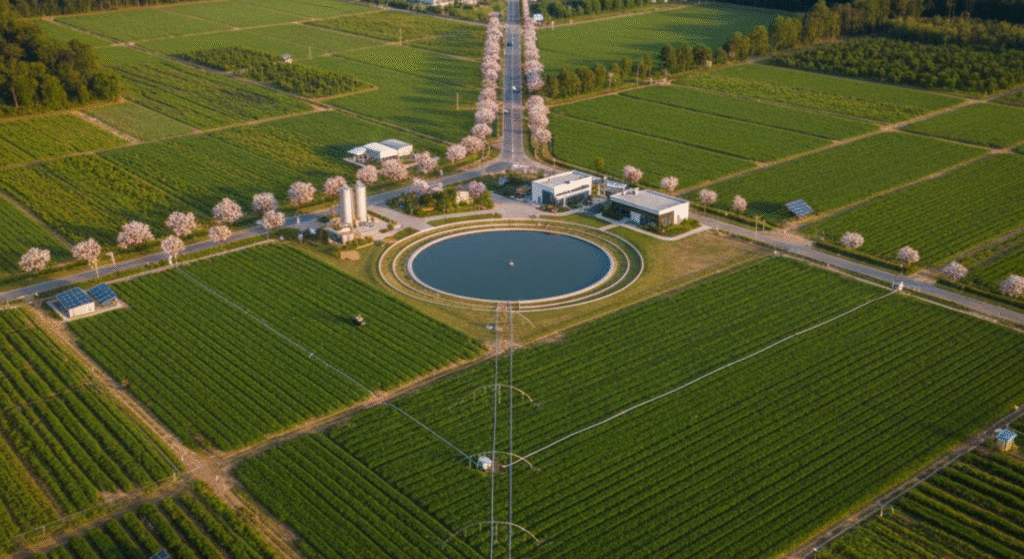

Why Choose Dhanveda Farmlands?

1. Legally Clear Farmlands

Every project comes with complete title verification, transparent documentation, and zero legal disputes — ensuring a fully secure investment.

2. Hassle-Free, Fully Managed Ownership

Dhanveda handles land development, irrigation, plantation, and crop maintenance. You earn returns without any farming experience.

3. Prime Locations Near Bangalore

4. Dual Returns

Earn yearly income from crops plus 10–15% annual land value growth, making it a powerful long-term wealth builder.

5. Sustainable, Organic Practices

Dhanveda uses eco-friendly, organic, and water-efficient farming methods for a greener investment experience.

6. Weekend Retreat Benefit

Farmlands are designed as peaceful green spaces, perfect for family visits and weekend getaways.

7. Transparent Pricing & Investor Support

You get clear pricing, no hidden charges, and regular updates — building trust and confidence.

8. Large Community of Happy Investors

Trusted by urban families, NRIs, and first-time land buyers — backed by strong testimonials and satisfaction.

Conclusion

While mutual funds offer liquidity and diversification, they also come with high volatility, constant monitoring, and unpredictable returns.

Managed farmland, on the other hand, offers:

- Low risk

- Stable income

- Land ownership

- Strong appreciation

- Peace of mind

For Bangalore-based investors seeking a safer, stable, and long-term wealth-building asset, managed farmland stands out as the smarter choice.

FAQs

1. Is managed farmland really safer than mutual funds?

Yes. Managed farmland is a low-risk, asset-backed investment. It doesn’t depend on market swings like mutual funds. You get stable returns through crop income plus long-term land value appreciation.

2. How much return can I expect from managed farmland?

3. Why should I choose Dhanveda Farmlands over other farmland companies?

Dhanveda offers legally verified lands, full farm management, sustainable farming, and properties in high-growth locations near Bangalore. You get stress-free ownership with transparent pricing and steady returns.

4. Can I visit my farmland anytime if I invest with Dhanveda?

Yes, absolutely. Investors can visit their farmland anytime, use it as a weekend retreat, check the plantation progress, and enjoy the property whenever they like.

5. Are managed farmlands suitable for first-time investors?

6. What makes farmland a better long-term investment than mutual funds?

Farmland is a real, appreciating asset that grows in value every year, even during market crashes. Unlike mutual funds, farmland offers stability, inflation protection, and lifetime ownership benefits.