Farmland is no longer seen only as a place to grow crops — it’s increasingly being recognized as a secure long-term investment, a lifestyle upgrade, and a natural hedge against inflation. Across Karnataka, more individuals and investors are turning to agricultural land for both financial growth and sustainable living.

If you’re considering buying farmland in Karnataka, one of the first and most important questions you’ll ask is: “What is the cost of one acre in 2025?”

In this article, we’ll break down the current farmland prices, explain the key factors that influence land value, highlight regional variations across Karnataka, and share practical insights to help both new and experienced investors make informed decisions.

Overview: Agricultural land in Karnataka

Karnataka offers a rich and diverse agricultural landscape—from fertile plains to hilly terrains, from irrigated tracts to rain-fed stretches. With shifts in the economy, urban expansion and changing regulatory policies, farmland pricing has been evolving. Understanding the broader context helps you interpret the numbers better.

What is the cost of one acre of farmland in Karnataka in 2025?

Based on recent market references, the baseline average cost for one acre of agricultural land in Karnataka in 2025 ranges around ₹ 40 lakh to ₹ 45 lakh for many parts of the state.

However, in highly demanded zones (especially near urban hubs, strong infrastructure, good connectivity), prices can be much higher, running into crores.

It is important to stress: these are indicative figures. The actual cost depends very heavily on location, quality, availability of water, type of crops, accessibility and other variables.

Key factors that affect one‐acre farmland cost in Karnataka in 2025

- Location & Connectivity: Farmland nearer to urban centres or major towns, with good road access and proximity to markets, command higher prices.

- Soil quality & crop potential: Land with fertile soil, suitable for high-value crops (spices, coffee, areca nut etc) or established cultivation fetches higher value.

- Water availability & irrigation: Access to bore wells, canal irrigation or natural sources adds premium. Rain‐fed land tends to cost less.

- Topography & ease of cultivation: Flat, even terrain is easier and cheaper to farm; hilly or difficult terrain may lower price or increase cost of development.

- Infrastructure and amenities: Presence of basic infrastructure like electricity, roads, proximity to input suppliers, transport adds to value.

- Regulatory / zoning / land‐use factors: State regulations, whether the buyer is agriculturist or non-agriculturist, whether conversion is possible, these all matter.

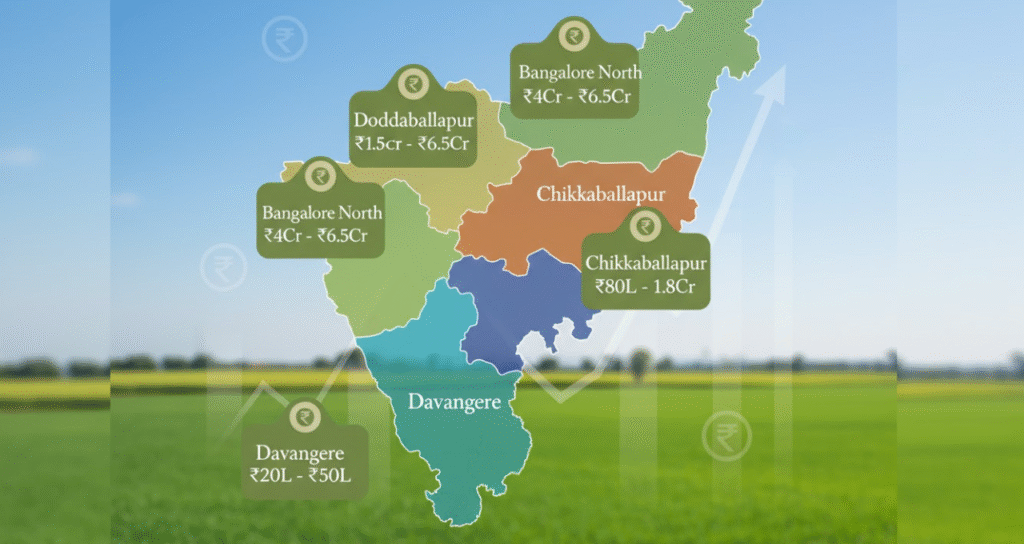

Regional pricing: Variation across Karnataka

Because of the above factors, there is huge variation in farmland costs across Karnataka. Here are examples to give you a feel:

- Near the Bengaluru region / peri-urban zones: Some sites report starting at ₹ 6.5 crore per acre (e.g., around Chandapura) in highly developed pockets.]

- Other semi-rural areas: e.g., starting around ₹ 1 crore to ₹ 1.7 crore per acre in parts of Doddaballapura.

- More remote or purely agrarian zones: Starting from as low as ₹ 41.90 lakh per 6000 (in certain rural districts) for land with lesser connectivity or infrastructure.

- Examples: In Davangere region the range is quoted from ~₹ 41.90 lakh up to ~₹ 50 lakh per 6000 sq.ft depending on location.

Takeaway: The headline “₹ 41.90 lakh per 6000 sq.ft” is a ball-park average. If you are looking in premium zones, expect much higher; if you are looking in more remote, less serviced zones, you might find lower.

What this means for investors & farmers

For you at DhanVeda Farmlands looking to buy or advise buyers:

- Treat the ₹ 40–50 lakh figure as a reference baseline, not a fixed ceiling or floor.

- Always benchmark the specific plot you are considering against the key factors above (connectivity, water, soil, infrastructure). A poor plot might be significantly cheaper; a premium plot significantly costlier.

- Consider future appreciation: land near expanding infrastructure (roads, towns, commerce) may see faster value growth.

- Understand total cost: It’s not just the land price. There will be legal costs, registration, possible conversion (if required), development cost (irrigation, fencing, road access) — factor these in.

- Think about intent: Are you buying purely for farming/income OR for investment/appreciation OR for both? Your target-use will influence how you value the land.

- Legal due‐diligence: Ensure title is clear, check if the land is agricultural classified (and whether purchase by a non-agriculturist is permitted under local law).

How DhanVeda Farmlands can help

At DhanVeda Farmlands, our objective is to help you navigate this landscape with clarity and confidence. Whether you are:

- a first-time buyer looking for affordable farmland with growth potential;

- a seasoned investor seeking high-value plots near developing hubs;

- a farmer looking for plots optimized for cultivation and income —

we support you with market intelligence, on-the-ground verification, plot screening and legal oversight.

Conclusion

In 2025, farmland in Karnataka is seeing a wide spectrum of pricing. A good benchmark average is ₹ 40 lakh to ₹ 50 lakh per 6000 sq.ft for many viable agricultural plots. But don’t let that oversimplify things: location, connectivity, infrastructure, crop-potential and regulation can swing prices drastically higher—or lower.

FAQs

Can non-agriculturists buy farmland in Karnataka in 2025?

Yes — the regulations have been amended to allow non-agriculturists (meeting certain income/other criteria) to purchase agricultural land under approval.

Is farmland near a city always more expensive?

Generally yes — but only if other factors (water, soil, connectivity) are favourable. Proximity to urban zones increases development and investment potential, which increases price.

If I buy a plot for ₹ 41.90 lakh per sq.ft, will it definitely appreciate?

No guarantee, but buying a well-positioned plot (good connectivity, water, near growth corridor) increases your chances. Like any investment, risk remains.