Are you searching for a secure, future-proof investment that delivers steady passive income, high capital appreciation, and tax benefits? You’re not alone. In 2025, a huge percentage of investors — especially NRIs and professionals from Tier-1 cities — are moving towards managed farmland investments due to their reliability and wealth-building potential.

Unlike volatile real estate and stock markets, agricultural land has never declined in long-term value. With rising food demand, export growth, and limited farmland availability near major cities, managed farmlands are becoming the smartest investment choice for 2025 and beyond.

That’s why Dhanveda Farmlands has designed premium farmland projects near Bengaluru that offer legal ownership + professional farm management + passive income, giving investors all the benefits without the burden of farming.

Why Managed Farmland Is a Goldmine for Investors in 2026

Managed farmland combines asset security + agricultural income + land appreciation — a powerful combination that very few investments provide.

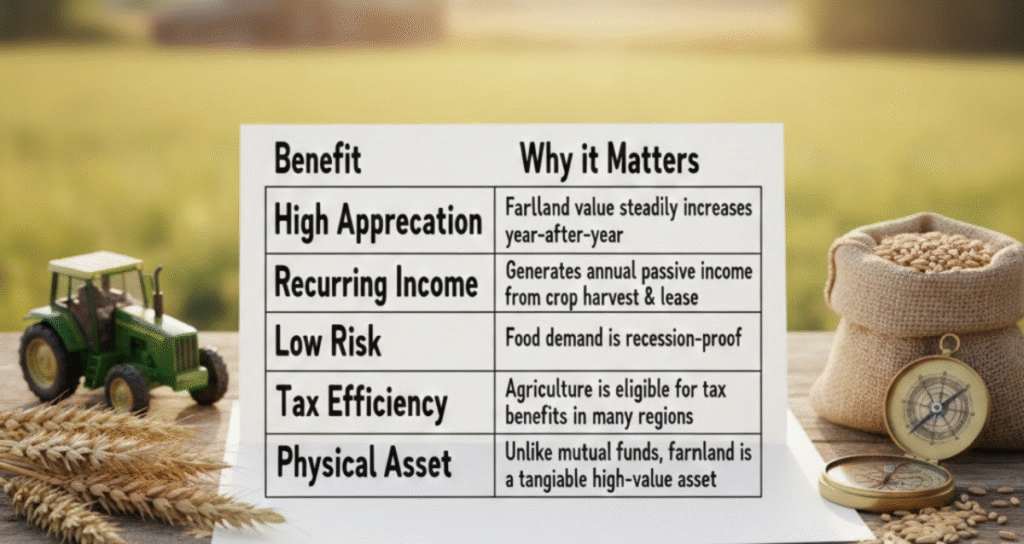

Key Benefits of Managed Farmland Investments

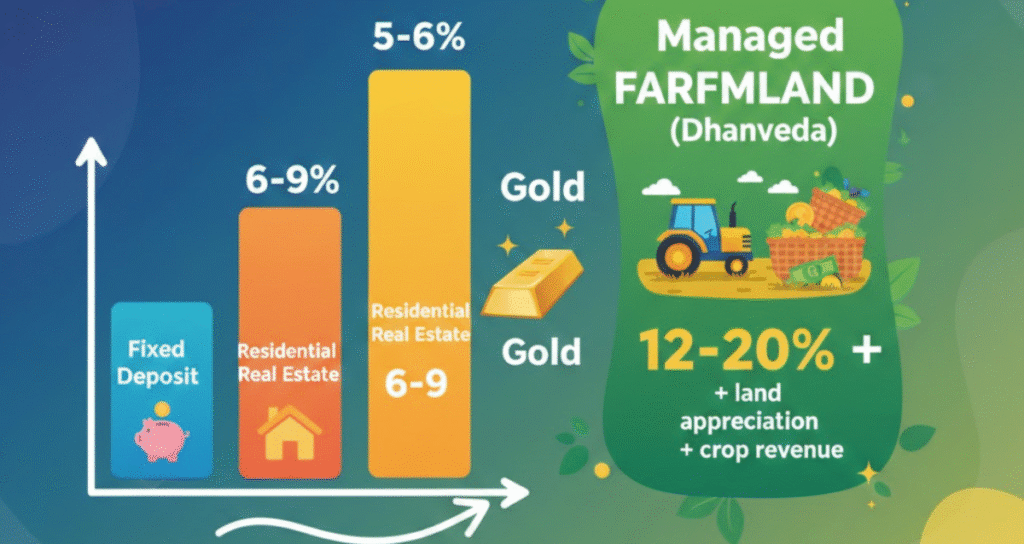

In the last 20 years, farmland ROI has outperformed gold, mutual funds, and even real estate. With limited agricultural land available and the population rising, the demand–supply gap strongly favors investors.

What Exactly You Get When You Invest in Managed Farmland

Managed farmland is not just land—it is a complete agricultural investment ecosystem. When you purchase a plot, you gain access to:

1. Verified Land Ownership

You legally own the land with:

- Title deed

- 7/12 or local land records

- Clear conversion status

- Demarcation and fencing

2. Professional Farm Management

A skilled agriculture team handles:

- Soil & crop selection

- Irrigation management

- Pest control

- Harvesting & crop trading

- Farm maintenance

3. Income-Generating Farmland Plan

You earn through two strong streams:

- Crop profits / Harvest income

- Land value appreciation

Many projects also offer guaranteed income plans and profit-sharing models.

4. Optional Add-Ons

Some developers provide:

- Farmhouse construction

- Weekend stay amenities

- Solar-powered irrigation

- Drip irrigation system

How to Maximize Your ROI with Managed Farmland

A smart plan can multiply returns without additional investment. Here is a 3-step roadmap for 2025:

Step 1: Select High-Growth Farmland Zones

Look for:

- Areas with planned infrastructure development

- Water-rich agricultural belts

- Proximity to a metro city

- Year-round cultivation potential

Regions near expanding cities (Example: Bengaluru) have shown the fastest appreciation and rental demand.

Step 2: Choose Cash-Crop-Ready Projects

Crops impact profitability. Choose projects cultivating:

- Mango

- Sandalwood

- Teak

- Coconut

- Spices & Superfoods

These crops provide:

- Higher market value

- Contract-farming buyers

- Multi-year returns

Step 3: Leverage Post-Harvest Monetization

Here are winning strategies used by top investors:

| Strategy | Income Advantage |

|---|---|

| Direct farm-to-market sales | Eliminates middlemen |

| Contract farming | Guaranteed purchase rates |

| Timber long-term income | High-value harvest after maturity |

| Farm tourism / weekend stays | Rental income boost |

Realistic ROI Snapshot

Investors don’t just grow wealth — they build assets for future generations.

Why Investors Prefer Dhanveda Farmlands

- Legally secure farmland ownership

- End-to-end farm management

- Transparency in documentation and profitability

- Child & family-friendly farm amenities

- Perfect for weekend getaway + long-term wealth growth

From first-time buyers to NRIs, Dhanveda has become a trusted partner in farmland investment.

Why Managed Farmland is the Smartest Investment for 2026

Managed farmland is not just another real-estate asset — it is a future-proof, income-generating ecosystem. With a dependable partner like Dhanveda Farmlands, investors enjoy secure land ownership, professional farm management, and continuous income from agricultural returns without handling any farming work themselves.

If your 2025 financial goal is passive income + secure asset ownership + long-term wealth creation, then investing in managed farmland is one of the safest and smartest decisions you can make. With Dhanveda Farmlands, you’re not just purchasing land — you’re building a generational wealth asset that grows year after year.

FAQs

1. What is the minimum investment required to buy managed farmland?

Most buyers want to know whether it fits their budget. Projects generally start from ₹12–₹40 lakhs per acre depending on location, crop plan, and included amenities. Some developers also offer easy installment options.

2. How soon can I start earning income from the farmland?

3. Will the land be legally registered under my name?

Yes. Buyers receive full legal ownership with title deed and land documents. This ensures long-term land security and inheritance benefits for future generations.

4. Do I need to be physically present to manage the farm?

No. The entire farming operation — crop planning, irrigation, labor, harvest and sales — is handled by professional farm management teams. Buyers receive periodic performance and income reports.

5. Can I build a farmhouse on my farmland?

Yes, in most managed farmland projects buyers can construct a personal farmhouse for weekend stays or rental income, based on approved layout and government regulations.

6. How is the return calculated — only on land appreciation or crop income too?

Returns are generated through two income streams:

✔ Land value appreciation — increases every year

✔ Crop income / harvest revenue — recurring passive earnings

A combination of both creates 12–20% average annual ROI over the long term.

7. Is this investment suitable for NRIs or people living outside the country?

Absolutely. Managed farmland is ideal for NRIs because everything from land purchase to crop management is handled by professionals. Remote owners can monitor farm progress through monthly reports and visits when they travel to India.