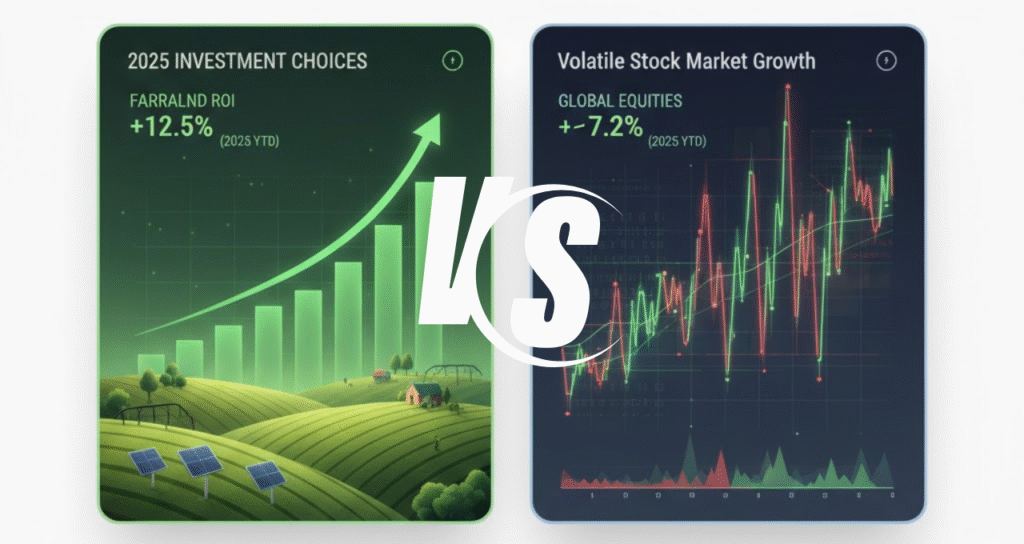

Investors today are looking beyond volatile markets and exploring assets that combine security, growth, and sustainability. While the stock market has long been a go-to investment, 2025 has revealed a growing shift — towards managed farmlands.

With rising global food demand, limited arable land, and government support for agri-based investments, managed farmland is no longer just a passion project; it’s a serious wealth-building avenue for modern investors.

Stock Market: High Returns, Higher Volatility

The stock market is built on fluctuations — driven by company performance, policy changes, global trends, and sometimes, pure speculation.

- Unpredictable: Prices can crash overnight due to economic or political events.

- Emotion-driven: Investor behavior often causes irrational ups and downs.

- Requires active tracking: Managing a stock portfolio demands time, analysis, and constant updates.

- Short-term focus: Many investors chase quarterly returns rather than building generational wealth.

For risk-tolerant investors, stocks can work well. But for those who want peace of mind and tangible growth, farmland provides a steadier alternative.

Managed Farmland: Tangible, Secure & Growth-Oriented

Unlike shares or digital assets, managed farmland gives you real ownership of appreciating land. You’re not just buying soil — you’re buying a self-sustaining ecosystem managed by professionals.

Here’s why it’s winning investor confidence:

1. Stability Over Speculation

Farmland values rarely crash. Even during market corrections, agricultural land tends to appreciate steadily — protected by food demand and limited supply.

2. Tangible Asset You Can See & Feel

3. Managed for Passive Returns

Modern farmland projects near Bangalore (like Dhanveda Farmlands) offer full management — from soil care to crop planning and water management — giving you annual yield income + long-term appreciation.

4. Hedge Against Inflation

When prices rise, so do crop values and farmland prices. That means farmland naturally protects your wealth over time.

5. Sustainable & Eco-friendly

Investing in farmland contributes to environmental well-being — with tree planting, organic farming, and carbon capture — unlike paper-based assets that have no physical value.

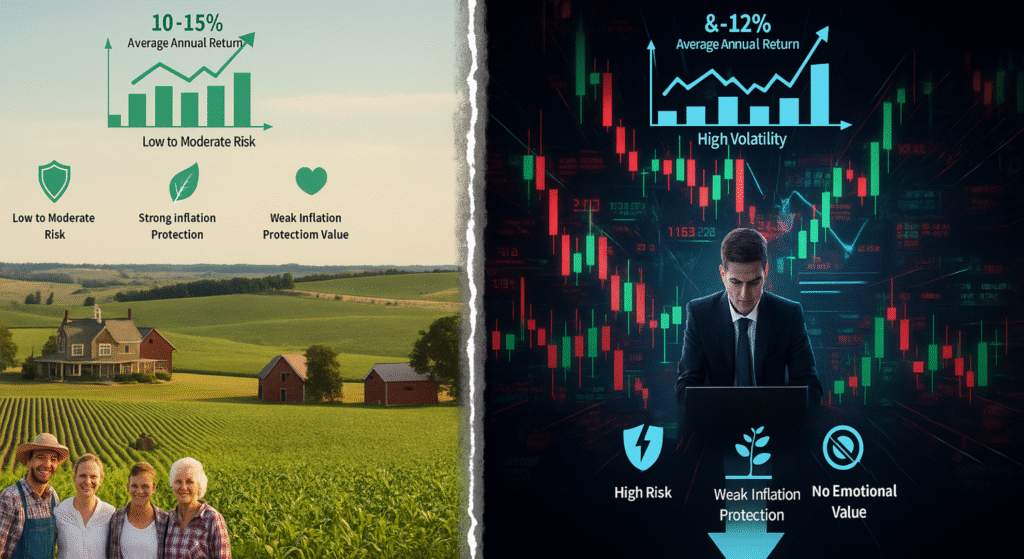

Data Comparison: Managed Farmland vs Stock Market (2020–2025)

| Feature | Managed Farmland | Stock Market |

|---|---|---|

| Average Annual Return | 10–15% (land + yield) | 8–10% (volatile) |

| Risk Level | Low to Moderate | High |

| Ownership Type | Tangible Land Asset | Digital Financial Asset |

| Inflation Protection | Strong | Weak |

| Emotional Value | High (eco + lifestyle) | None |

| Volatility | Minimal | High |

| Management | Fully handled by experts | Requires active tracking |

Why Dhanveda Farmlands Stands Out

If you’re considering managed farmland near Bangalore, Dhanveda Farmlands offers a rare blend of nature, management, and investment transparency.

Here’s what makes Dhanveda different:

1. Legally Clear & Professionally Managed

Every plot is legally verified, converted, and managed by agri-experts — ensuring your investment is safe and fully compliant.

2. Smart Agri Management

From soil enrichment and drip irrigation to crop rotation and organic farming — Dhanveda’s expert team manages every aspect, letting you earn passive returns without lifting a finger.

3. Eco-Living Meets Investment

4. High ROI + Lifestyle Value

Beyond appreciation, Dhanveda Farmlands offers a weekend retreat experience — peaceful, scenic, and within driving distance from Bangalore. It’s both an asset and a lifestyle upgrade.

Rooted Growth: The Smarter Path to Stable Returns

In a time when stock markets rise and fall like tides, managed farmland offers the calm of the countryside and the steady growth of a well-rooted tree.

Beyond returns, it provides something deeper — a tangible asset you can see, feel, and nurture. Managed farmlands combine modern investment intelligence with the timeless value of nature, creating a rare balance between profit and peace.

If you seek steady returns, peace of mind, and a connection to nature, farmland isn’t just an investment — it’s a legacy that grows stronger with every season.

FAQs

Is managed farmland better than the stock market?

Managed farmlands offer steady growth, passive income, and low risk—ideal for long-term wealth vs stock market volatility.

How does managed farmland work?

You own a legal farmland plot, and experts manage cultivation, irrigation, and care. You earn passive income and land appreciation.